Report Overview

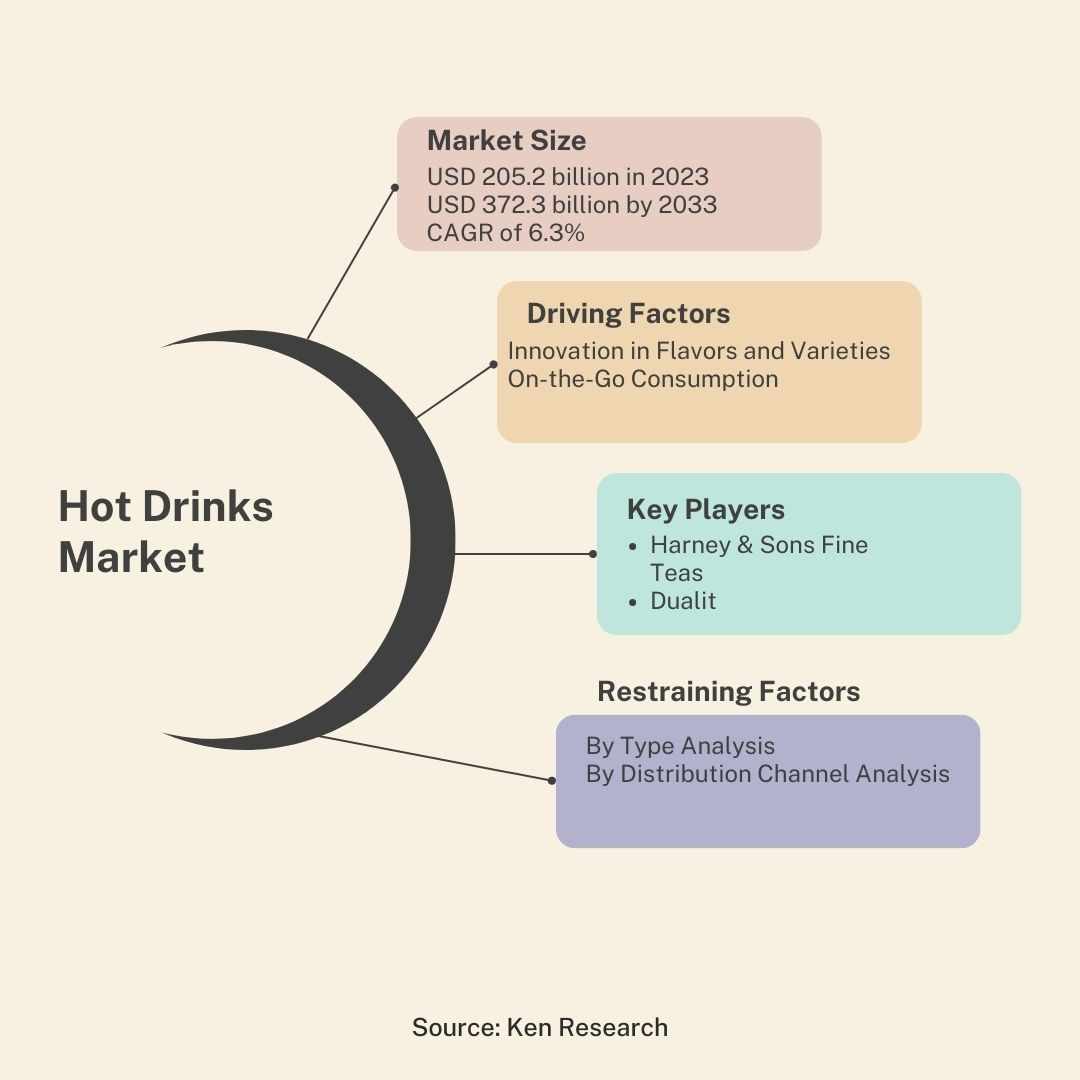

The Hot Drinks Market was valued at USD 205.2 billion in 2023. It is expected to reach USD 372.3 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

The Hot Drinks Market encompasses the global trade of beverages traditionally served hot, such as coffee, tea, and hot chocolate. This market is driven by increasing consumer demand for premium and specialty beverages, the health benefits of certain hot drinks, and the expanding café culture. The market's growth is further propelled by innovations in flavor, packaging, and sustainability.

Key Takeaways

Market Growth: The Hot Drinks Market was valued at USD 205.2 billion in 2023. It is expected to reach USD 372.3 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

By Type: Coffee dominated the Hot Drinks Market driven by consumer preferences.

By Distribution Channel: Hypermarkets and Supermarkets dominated the hot drinks market distribution.

Regional Dominance: North America dominates the hot drinks market with a 35% largest share.

Growth Opportunity: The global hot drinks market offers vast opportunities through premiumization and wellness-focused innovations, driving consumer satisfaction and market growth.

Driving Factors

Innovation in Flavors and Varieties: Enhancing Consumer Engagement Innovation in flavors and varieties has significantly contributed to the growth of the hot drinks market. The introduction of unique and diverse flavors caters to the evolving tastes and preferences of consumers, thereby increasing market penetration. For instance, the incorporation of exotic flavors like matcha, turmeric, and various fruit infusions has attracted a broader consumer base.

Convenience and On-the-Go Consumption: Meeting Modern Lifestyle Needs The increasing demand for convenience and on-the-go consumption options has propelled the growth of the hot drinks market. Modern consumers seek products that align with their fast-paced lifestyles, leading to a surge in the popularity of ready-to-drink (RTD) beverages and single-serve coffee pods. The global market for RTD hot beverages was valued at USD 12.3 billion in 2023, demonstrating a strong preference for convenient consumption formats.

Restraining Factors

Impact of Cold Beverage Alternatives on the Hot Drinks Market The hot drinks market faces significant competition from cold beverages, which have gained popularity due to their refreshing qualities and convenience. This competition has been intensified by the increasing availability and variety of cold beverage options such as iced coffee, iced tea, and ready-to-drink (RTD) beverages. These alternatives are particularly appealing in warmer climates and during summer months, reducing the overall demand for hot drinks.

The growth of the global RTD tea and coffee market, valued at approximately USD 86 billion in 2023 and projected to grow at a CAGR of 6.5% from 2023 to 2028, illustrates this trend. This rapid growth indicates a shifting consumer preference toward cold beverages, thereby restraining the expansion of the hot drinks market.

By Type Analysis

Coffee Dominated the Hot Drinks Market in 2023, Driven by Consumer Preferences In 2023, Coffee held a dominant market position in the By Type segment of the Hot Drinks Market. Coffee accounted for the largest share, driven by a growing consumer preference for specialty coffee and the proliferation of coffee shops globally. The segment's growth can be attributed to the increasing demand for premium and convenient coffee products, such as single-serve pods and ready-to-drink (RTD) coffee beverages.

Others in the segment, which include hot chocolate, melted drinks, and other traditional beverages, maintained a steady market presence. These drinks are particularly popular among younger consumers and in regions with strong cultural preferences for specific hot drinks. Innovations in flavor and packaging have helped sustain their market share.

By Distribution Channel Analysis

In 2023, Hypermarkets and Supermarkets Dominated the Hot Drinks Market Distribution In 2023, Hypermarkets and Supermarkets held a dominant market position in the distribution channel segment of the hot drinks market. This dominance can be attributed to the wide availability and accessibility of hot drink products in these retail environments, where consumers prefer the convenience of one-stop shopping.

Latest Trends

Increased Demand for Natural and Eco-Responsible Products The hot drinks market is witnessing a significant shift towards natural and eco-responsible products. Consumers are increasingly prioritizing sustainability and health, driving demand for beverages made with organic ingredients and minimal environmental impact. This trend is propelled by a growing awareness of climate change and health consciousness. Companies are responding by sourcing raw materials sustainably, reducing packaging waste, and obtaining certifications such as Fair Trade and Organic. The result is a competitive edge for brands that align with these values, fostering loyalty and enhancing market share.

Regional Analysis

North America Dominates the Hot Drinks Market with a 35% Largest Share The global hot drinks market exhibits significant regional variation, driven by diverse consumer preferences and purchasing power. In North America, the market is robust, characterized by a high demand for premium coffee and specialty teas. The region commands approximately 35% of the global largest market share, driven by a strong coffee culture in the United States and Canada.

In the Middle East & Africa, the market holds approximately 10% of the share, with a notable preference for traditional hot beverages such as tea and coffee, alongside an emerging market for premium brands. Latin America represents around 5% of the market, driven largely by Brazil's significant coffee production and consumption.

Key Players Analysis

The global hot drinks market in 2024 is poised for robust growth, driven by a diverse array of key players, each contributing unique strengths and strategic initiatives.

The Coffee Bean & Tea Leaf and Harney & Sons Fine Teas are expected to maintain their strong presence with premium offerings, leveraging their established brand loyalty and expanding their product lines to include healthier and organic options. Unilever and Nestlé SA, giants in the consumer goods sector, are anticipated to further innovate in product formulations and sustainable practices, aligning with the increasing consumer demand for eco-friendly products.

Gourmesso and Dualit will likely continue to capitalize on the growing popularity of convenient, high-quality single-serve coffee pods, while Dilmah Ceylon Tea Company PLC and Ippodo Tea Co. Ltd. focus on their rich heritage and premium tea offerings to attract discerning tea enthusiasts.

New entrants such as Tranquini, Chillbev, Som Sleep, and Phi Drinks, Inc. are expected to disrupt the market with their wellness-focused beverages, catering to the rising trend of functional drinks that promote relaxation and health benefits.

Market Key Players

The Coffee Bean & Tea Leaf

Unilever

Gourmesso

Harney & Sons Fine Teas

Dualit

6. Nestlé SA

Write a comment ...